Following the United States Trade Representative’s (USTR) Section 301 Four-Year Review Report, today USTR released a pre-publication Federal Register notice with further details on its proposed modifications to the Section 301 tariffs, including dates and specific Harmonized Tariff Schedule of the United States (HTSUS) subheadings. Once officially published in the coming days, USTR’s notice will also open a one-month comment period concerning (a) the effect and scope of proposed tariff increase and (b) the scope of proposed exclusions for manufacturing machinery (including solar production).

Proposed Increases to Section 301 Tariffs

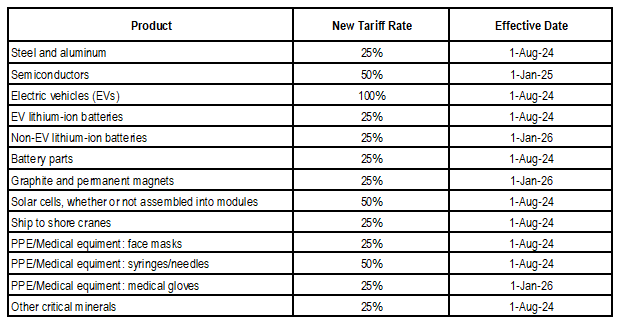

In Annex A of the Federal Register notice, the USTR details 382 specific HTSUS subheadings covering approximately $18 billion in annual trade value for which USTR has proposed increasing Section 301 tariff rates. The USTR has added HTSUS subheadings, rates, and implementation dates for the following product categories:

Introduction of Exclusion Process for Manufacturing Equipment

The USTR’s notice states that procedural details for the proposed manufacturing equipment exclusion process will be provided in a separate notice. For now, Annex B of the draft notice identifies the 8-digit HTSUS subheadings under Chapters 84 and 85 that USTR proposes to make eligible for the exclusion process. Annex C describes nineteen types of solar manufacturing equipment to be granted immediate exclusions effective on the notice’s date of publication.

Exclusions granted for manufacturing equipment (including solar manufacturing equipment) will be effective through May 31, 2025.

Request for Public Comments

Having provided these details concerning its proposed modifications to Section 301 tariff rates, the USTR will be opening a public comment period (USTR Docket USTR-2024-0007) for interested parties to provide feedback on several key areas:

For tariff increases:

- The effectiveness of the proposed modification in obtaining the elimination of or in counteracting China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation;

- The effects of the proposed modification on the U.S. economy, including consumers;

- The scope of the product description to cover ship-to-shore cranes under subheading 8426.19.00 (Transporter cranes, gantry cranes and bridge cranes);

- With respect to facemasks, medical gloves, and syringes and needles, whether the tariff rates should be higher than the proposed rates;

- with respect to facemasks, whether additional statistical reporting codes under tariff subheading 6307.90.98 should be included; and

- Whether the tariff subheadings identified for each product and sector adequately cover the products and sectors included in the President’s direction to the Trade Representative.

For manufacturing equipment exclusions:

- Whether subheadings listed in Annex B should be included in the exclusion process;

- Whether additional subheadings listed in HTSUS Chapters 84 & 85 should be eligible for the manufacturing equipment exclusion process; and

- Whether USTR should amend the scope or product description for solar manufacturing machinery exclusions listed in Annex C.

The pre-publication notice indicates that the online submission portal for written comments will be open from May 29 to June 28. CLK is available to assist interested parties in preparing and submitting their comments.