On July 31, 2025, President Donald Trump issued an Executive Order (EO) titled “Further Modifying the Reciprocal Tariff Rates,” acting under the International Emergency Economic Powers Act (IEEPA). This EO builds on the “reciprocal” tariffs imposed in April of this year pursuant to Executive Order 14257 by modifying certain country-specific tariff rate assignments and introducing new procedural safeguards. Broadly, this is a further step towards implementing the President’s “America First Trade Policy.” The modified “reciprocal” tariffs set out in the EO will be applied on imports effective August 7, 2025.

The revised tariff framework also operates as a status update for bilateral negotiations with various key U.S. trading partners. As with earlier trade measures, the only countries “exempted” from the reciprocal tariff measures are those with which the U.S. lacks normal trading relations (Belarus, Cuba, North Korea, and Russia) as these imports are already subject to “column 2” (not Most Favored Nation) tariff rates. Because all countries are now either covered or expressly excluded, U.S. Customs and Border Protection (CBP) expects all imports effective August 7 to report at least one HTSUS Chapter 99 secondary classification related to the reciprocal tariffs, i.e., applying the tariffs or identifying applicable exemptions.

Most Country-Specific Rates Are Lower than Announced in April

When the Trump Administration announced the IEEPA “Reciprocal” Tariff regime on April 2, 2025, the announcement was accompanied by a table of country-specific rates. For the most part, the country-specific rates were suspended to allow time for negotiations, which have occurred over the intervening four months, yielding announcements of term sheet trade deals completed with the United Kingdom, European Union, Vietnam, Indonesia, Japan, South Korea, and the Philippines, although the announcements have varied substantially in their precision and detail, and others may still be forthcoming.

The structure of some of the trade deals has been novel. In particular, the duty rates negotiated with the European Union are structured to account for existing Column 1 General rates of duty. Thus, products of the European Union have two separate country-specific “Reciprocal” tariff subheadings:

- First, where an article has a Column 1 duty rate of 15 percent or greater, no further “Reciprocal” tariff will be incurred (9903.02.19).

- Second, an article having a Column 1 duty rate of less than 15 percent will incur a 15 percent “Reciprocal” tariff but will not incur the Column 1 duty rate (9903.02.20). For all other jurisdictions, the “Reciprocal” tariff is assessed in addition to the Column 1 duty rate. The implementing language for the Harmonized Tariff Schedule of the United States (HTSUS) even describes how to convert specific or compound duty rates to a percentage for purposes of identifying the correct “reciprocal” tariff provision for products of the European Union.

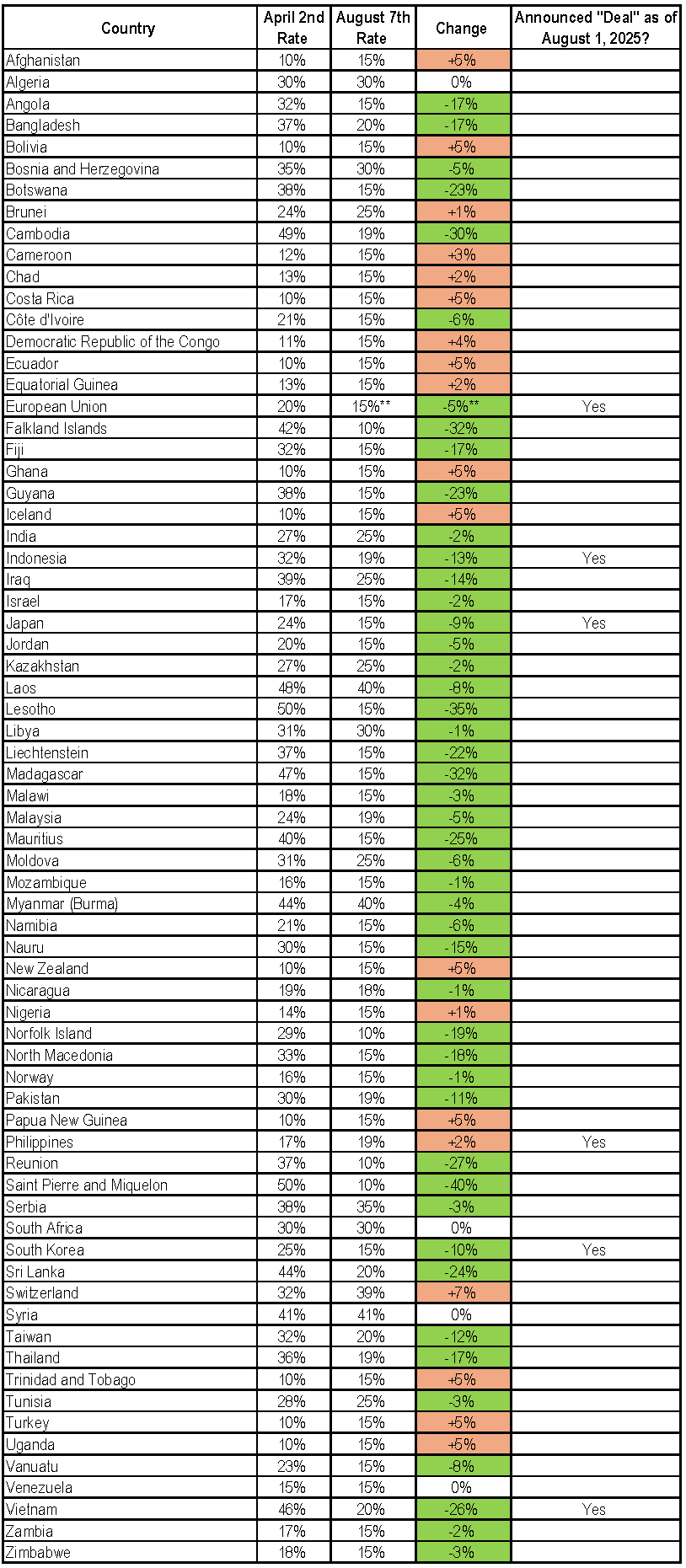

As summarized in the table below and although formal informal trade deals have been announced publicly with a handful of countries, the updated country-specific tariff rates include forty-two countries in which the tariff rates decreased compared to the rate originally announced for that country on April 2. Some of the decreases are relatively insignificant (1-2%), but others are substantial (over 10%). The EO appears to explain the matter as “trading partners {that} have agreed to, or are on the verge of agreeing to, meaningful trade and security commitments with the United States, this signaling their sincere intentions to permanently remedy the trade barriers that have contributed to” the circumstances that prompted the Trump Administration to impose the “Reciprocal” tariffs in the first place. Thus, it is entirely possible that further “deal” announcements will follow, and the “Reciprocal” tariff rates may decrease further once commitments are solidified. Deals with other countries (e.g., Cambodia and Thailand) have been referenced by Cabinet officials, though have not been formally announced or referenced by the President.

There are also nineteen countries in which the tariff rate has increased as compared to April 2, including ten that began at the ten percent baseline and have since increased to fifteen percent. These appear to be what the EO contemplates when it states that “some trading partners that have failed to engage in negotiations with the United States or to take adequate steps to align sufficiently with the United States on economic and national security matters.” Likewise, most of the country-specific tariff rates that remain unchanged were initially at very high levels, including Syria, the country with the highest country-specific rate (41%).

The table below summarizes countries that will have a country-specific rate and shows the rate increase or decrease.

The Trump Administration’s deployment of country-specific tariff rates has differed for one country, the People’s Republic of China (PRC). The United States and the PRC initially engaged in tit-for-tat tariff escalations up to 125%, before negotiators for the two countries agreed to return to a 10% baseline. Currently, that détente is set to expire on August 12, 2025, although talks in Stockholm in July indicated a further extension. The PRC’s country-specific “Reciprocal” tariff rate (34%) is not affected by today’s EO.

Separately, although this EO maintains a 10% “reciprocal” tariff rate for Brazil, the President has taken separate action under IEEPA to impose an additional 40% tariff on products of Brazil, with certain exceptions, starting August 6, 2025. These two tariffs “stack” on top of one another, for a total of 50%.

Tariff Exemptions and Stacking

The EO preserves the product exemptions contained in Executive Order 14257, including those relating to Section 232 goods, critical minerals, semiconductors, books and informational materials, pharmaceuticals, and certain electronics. The current hierarchy governing the “stacking” of tariffs, provided for in Executive Order 14289 and amended in Proclamation 10947, remains in effect.

The July 31 EO establishes an “on the water” exemption designed to minimize disruption for shipments already en route to the United States. The exemption applies to goods that are loaded onto a vessel at the port of loading and in transit on the final mode of transit before 12:01 a.m. eastern daylight time 7 days after the date of this order, and entered for consumption, or withdrawn from warehouse for consumption, before 12:01 a.m. eastern daylight time on October 5, 2025.

Transshipment Provision Signals CBP’s Continued Enforcement-Orientation

In response to concerns over transshipment and the evasion of duty payments, the EO also provides that goods determined to have been “transshipped” for the purpose of evading the new duties may be subject to an additional duty of 40%, in lieu of the country-specific rate in effect, as well as any other fines and/or penalties and duties applicable to goods of the actual country of origin. While the exact framework for determining what constitutes “transshipment” (generally understood as routing goods through third countries for the purpose of evasion) remains to be seen, the EO confirms that CBP may not allow for mitigation or remission of any penalties assessed on imports found to be transshipped. We expect that “transshipment” issues may take the form of content-based restrictions to avoid “leakage” of any higher duty regime by inputs leaving one country for assembly and substantial transformation in another.

Meanwhile, Adjustments to Tariffs on Mexico and Canada Also Announced

With respect to Mexico, President Trump announced via social media that he had a conversation with Mexico’s President Scheinbaum and because the issues in U.S.-Mexico relations and trade are different than other countries, President Trump explained he would extend for a 90-day period the current status of tariffs on imports from Mexico. This means that the existing treatment of imports from Mexico is unaltered by the July 31 announcements.

With respect to Canada, and in contrast, President Trump issued an Executive Order providing that imports from Canada covered by the IEEPA fentanyl tariffs will increase from 25% ad valorem to 35% ad valorem. In addition, the EO imposed the same transshipment tariffs of 40% elsewhere discussed in this alert. The EO explained the reasons as (1) “failure to devote satisfactory resources to arrest, seize, detain, or otherwise intercept drug trafficking organizations, other drug or human traffickers, criminals at large, and illicit drugs” and (2) “Canada’s efforts to retaliate against the United States in response to Executive Order 14193,” which imposed the initial 25% IEEPA fentanyl tariffs. Although a meaningful escalation in tariff number, the practical impact may be limited insofar as articles of Canada that qualify as originating under USMCA remain exempt and pre-existing stacking rules apply. The EO threatens additional actions against Canada if it is deemed that Canada is not addressing the perceived security issues concerning the northern U.S. border and/or Canada retaliates against the United States.

But What About that Legal Challenge?

On the same day the President issued these new EOs, the full roster of active judges at the U.S. Court of Appeals for the Federal Circuit heard oral argument concerning the legality of the IEEPA tariffs applied to address fentanyl trade and to address the trade deficit. A majority of the judges reviewed the government’s case with skepticism that the language in IEEPA allowed for the breadth of the tariff regime that the President imposed. Much of the government’s argument was spent parrying back questions from the judges concerning (1) whether the statutory power to “regulate” includes the power to impose tariffs, (2) whether there are any limits on presidential authority under IEEPA in declaring the type of emergency and its remedy, and (3) whether other trade laws prescribe a more circumscribed solution to address the problem identified in promulgating the IEEPA tariffs. The Plaintiffs also faced pointed questions concerning the type of power Congress had conferred upon the President through the IEEPA statute. Based on the expedited case calendar to date, the Federal Circuit is likely to issue a merits decision in 30 to 60 days. Depending on Federal Circuit’s decision, it may be immediately appealed to the Supreme Court.

* * *

Preparing Supply Chains

Cassidy Levy Kent’s attorneys, economists, compliance experts, and licensed customs brokers are well-positioned to help and advise companies as they develop strategic responses to the latest changes in U.S. tariff policy and plan for potential developments. Our team’s deep familiarity with trade law and policy enables clients to adapt and stay ahead of the curve. We expect ongoing developments on these and other tariffs and will continue to provide updates. Please contact us with any questions.