Effective for entries made on or after November 13, 2025, the list of goods exempted from reciprocal tariffs has been expanded to include certain meat, vegetables, oils, food preparations, and fertilizers variously classifiable under 237 8-digit subheadings of the Harmonized Tariff Schedule of the United States (HTSUS). At the same time, eleven additional exclusions are introduced for certain products identified by description. Parties may seek refunds of reciprocal tariff payments made on entries of excluded goods on or after the effective date.

Product Exclusions Expand to Food & Fertilizer

In April, the President announced the imposition of a near-worldwide regime of “reciprocal” tariffs pursuant to the International Emergency Economic Powers Act (“IEEPA”). The tariffs have been formulated as generally applicable, unless an exclusion applies. Among other exclusions, products falling within certain subheadings of the HTSUS are not subject to reciprocal tariffs liability. The original Reciprocal Tariff executive order contained an open-ended section on modification authority which made clear that the list of excluded products was subject to change. Indeed, less than a week after the Reciprocal Tariffs entered into force, the list of excluded goods was expanded to include a broad swathe of consumer electronics. The list was modified again in September, removing eight products, including aluminum hydroxide and certain other chemical products, most of which relate to plastics; and adding thirty-nine products, including certain graphite, ores, organic chemicals, wood pulp, gold and other precious metals, zinc powder, NIB magnets, LEDs, and various articles containing nickel.

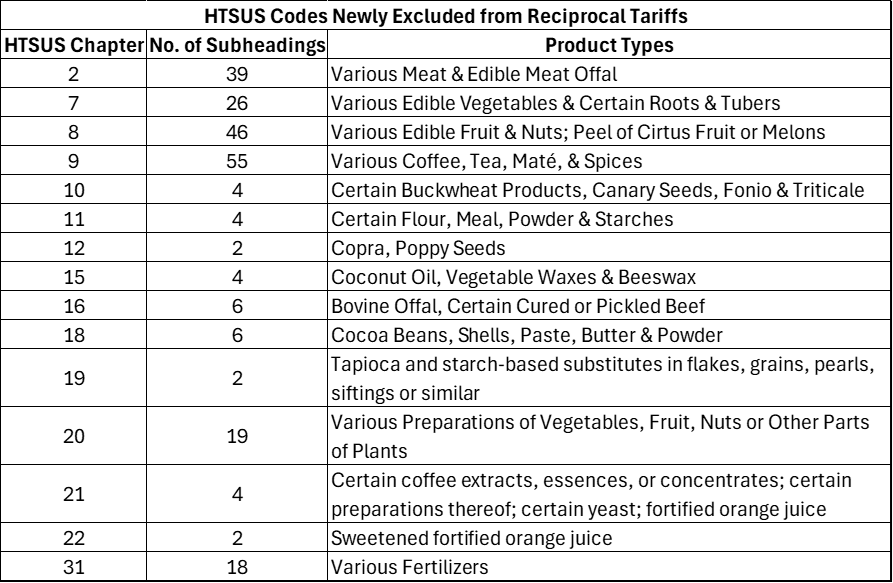

Last week, the list of excluded products was expanded further. The Executive Order attributes the change to “the status of negotiations with various trading partners, current domestic demand for certain products, and current domestic capacity to produce certain products.” As detailed further in the table below, the exclusions encompass articles classified in certain HTSUS subheadings appearing in Chapters 2, 7-12, 15-16, 18-22, and 31. Although a wide range of HTSUS chapters are covered, most exclusions are concentrated in meat, vegetables, fruit, nuts, coffee, spices, certain plant-based preparations, and fertilizers.

The full list of newly excluded HTSUS subheadings is available here, under Annex I, Heading 1.f.i.

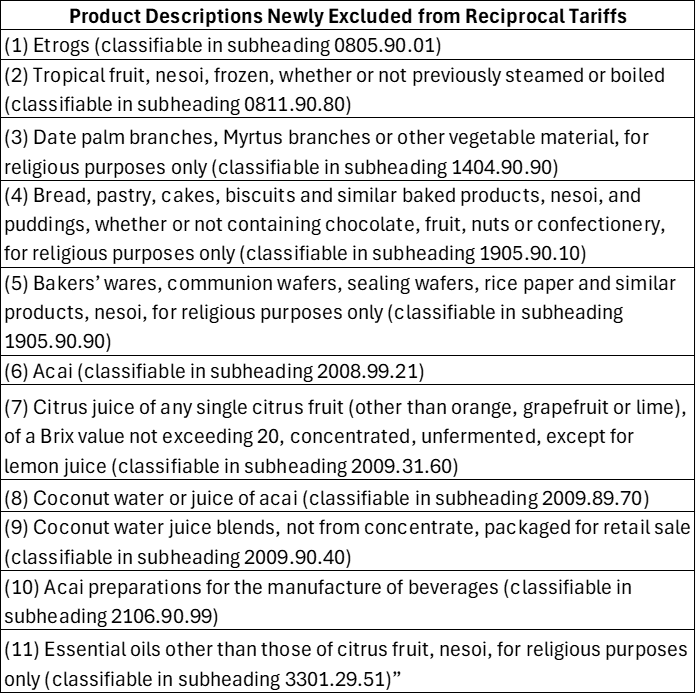

In addition, the Executive Order introduces a new type of exclusion, applicable to products fitting a certain description, rather than any product classifiable in a given HTSUS subheading. These types of exclusions, although familiar to the exclusions proceedings that previously existed with respect to the Section 301 tariffs on products of the People’s Republic of China, have not yet been used in connection with the reciprocal tariff regime. The specific exclusions are reproduced below, but there are two main types: (1) restricting a group of products to those used “for religious purposes only”; and (2) narrowing a subheading that covers multiple products to just one of the named types, e.g., limiting a basket “other” category (2008.99.21) to “Acai.” U.S. Customs and Border Protection (CBP) instructs that importers must maintain documentation “that substantiates proof of the product’s intended use, where applicable,” as CBP may request such documentation when reviewing the entry.

Normal Refund Procedures

As the Executive Order announcing this change was published the day after the new policy is scheduled to take effect, refunds will be necessary to effectuate the policy. Any refunds will be processed using standard U.S. Customs and Border Protection procedures. Specifically, the CSMS associated with this modification of the reciprocal tariff exclusions provides: “For entries filed within the last 10 days, correct entries within 10 days of the cargo’s release from CBP custody and prior to estimated duties being deposited to avoid needing refunds. For unliquidated entries for which estimated duties have already been deposited, importers may file a post summary correction (PSC) to request a refund. Upon PSC approval, the refund will be issued at liquidation. For liquidated entries, importers may request a refund by filing a protest within 180 days after liquidation in accordance with 19 U.S.C. 1514.”

Impact on Negotiations

The food and fertilizer products that have newly been granted exclusions from the reciprocal tariffs have, at the same time, been removed from the list of “Potential Tariff Adjustments for Aligned Partners” that was originally promulgated on September 5, 2025 in Executive Order 14346. Insofar as these products have now been excluded from reciprocal tariffs for all countries, the tariff adjustment is not limited to countries with which the United States has announced a Framework or an Agreement.

Notably, this includes certain products for which the recently announced agreements with Malaysia (e.g., HTSUS subheading 0801.11.00, and others) and Cambodia (e.g., HTSUS subheading 0709.99.05, and others) provided country-specific tariff exemptions. Although a country-specific exemption would not appear to have any additional effect for an already-exempt product, it is possible that the exclusions established by the bilateral deals will prove more stable and durable.

Adjusting Supply Chains and Negotiating

The attorneys, licensed customs brokers, compliance professionals, economists, and trade specialists of Cassidy Levy Kent regularly assist companies in evaluating their supply chains to ensure compliant market access and adjust for tariff-related developments, both mitigating burdens and taking advantage of opportunities. Cassidy Levy Kent also leverages its thorough understanding of relevant legal regimes to advise companies, governments, and other interested entities on tariff policy and procedures.