Late Tuesday President Trump signed an Executive Order (EO) increasing tariffs on steel, steel derivative articles, aluminum, and aluminum derivative articles under Section 232 of the Trade Expansion Act of 1962 (Section 232) from 25% to 50%. The EO also revises the tariff stacking hierarchy promulgated at the end of April in two respects. First, it adjusts the tariff treatment of articles otherwise falling under both Section 232 steel and/or aluminum tariffs and International Emergency Economic Powers Act (IEEPA) “Fentanyl” tariffs on Canada and Mexico. Second, it provides that the portion of a derivative steel and/or aluminum article’s value that is not subject to Section 232 steel and/or aluminum tariffs will be subject to IEEPA “Reciprocal” tariffs. This action was first previewed last Friday, during a speech at United States Steel Corporation’s Mon Valley Works–Irvin Plant in Pennsylvania, and later via social media. The increased rates and revised “stacking” mechanism will apply to subject products entered on June 4, 2025, or later.

Adjustments to Section 232 Steel and Aluminum Tariffs

The existing Section 232 tariff regimes on steel and aluminum articles were originally created in 2018. The tariffs were modified at various points during the first Trump and Biden Administrations, but continued to remain in place. Less than a month after taking office again, President Trump significantly modified both regimes. Generally speaking, those modifications to the steel and aluminum tariff regimes fixed a 25% rate, ended country- and product-specific exclusions, significantly expanded the list of “steel derivative” and “aluminum derivative” articles covered by each regime, and initiated the creation of processes for expanding “derivative” article coverage in the future.

Today’s modification invokes the need to “more effectively counter foreign countries that continue to offload low-priced, excess steel and aluminum in the United States market and thereby undercut the competitiveness of the United States steel and aluminum industries,” and marks the second Trump Administration’s second major adjustment to the Section 232 Steel and Aluminum tariff regimes. The Proclamation increases the tariff rate applicable to products subject to Section 232 steel and aluminum regimes from 25% to 50%, effective for entries dated June 4, 2025, or later.

However, the EO and associated CSMS Messages (#65236645 and #65236374) also provide for a degree of tariff liberalization. Application of the increased Section 232 tariff rates is expressly limited to “only to the steel content of articles in Chapter 73 of the [Harmonized Tariff Schedule of the United States (HTSUS)] and only to the aluminum content of articles in Chapter 76 of the HTSUS.” This is a clear change with respect to the non-derivative steel and aluminum articles implicated, as Section 232 duties had previously been assessed based on the full value of these articles. And it also changes the treatment of some derivative articles. Specifically, Note 16 to Subchapter III of Chapter 99 of the HTSUS (Rev. 13) identifies certain “derivative” steel products classified in HTSUS Chapter 73 that were previously assessed Section 232 steel duties upon their entire value, rather than the value of their steel content. Likewise, Note 19 previously provided that certain “derivative” aluminum products classified in HTSUS Chapter 76 were assessed Section 232 aluminum duties upon their entire value, rather than the value of their aluminum content.

The EO separately addresses the tariff treatment of steel articles that were previously admitted to a U.S. foreign trade zone under “privileged foreign status,” stating that upon entry for consumption on June 4, 2025, or later, they “shall be subject…to the provisions of the tariff in effect at the time of the entry.”

The one country-specific exception to this rule covers imports of articles of the United Kingdom. “[T]o allow for the implementation of the U.S.-UK Economic Prosperity Deal,” duties on imports of UK steel, steel derivative articles, aluminum, and aluminum derivative articles will remain at 25% until July 9, 2025, at which point the Secretary may “adjust the applicable rates of duty and construct import quotas” or “increase the applicable rates of duty to 50 percent.”

Revision of the Tariff “Stacking” Hierarchy

A hierarchy to reduce the “stacking” effect of certain IEEPA and Section 232 tariffs was created by a late April EO, as well as exclusions set forth directly in the IEEPA “Reciprocal” tariffs. Today’s EO modifies this hierarchy in two significant respects, in order to “ensure the effectiveness” of the Section 232 steel and aluminum tariffs. First, whereas the original “stacking” EO provided that articles subject to IEEPA “Fentanyl” tariffs on Canada or Mexico would not be subject to Section 232 steel and/or aluminum tariffs, today’s EO strikes that provision and instead provides that articles subject to Section 232 steel or aluminum tariffs will not be subject to IEEPA “Fentanyl” tariffs on Canada or Mexico.

Second, the February modifications to the Section 232 tariff regimes resulted in certain steel and/or aluminum derivative articles having the steel and/or aluminum portion of their value subject to Section 232 tariffs, whereas the non-steel, non-aluminum proportion of their value was not subject to these Section 232 tariffs. Today’s EO provides that derivative articles that are subject to Section 232 steel and/or aluminum tariffs will be assessed as follows:

- The proportion of the article’s value that is subject to Section 232 steel and/or aluminum tariffs (e., the steel and/or aluminum content) will incur Section 232 steel and/or aluminum tariffs; and

- The proportion of the article’s value that is not subject to Section 232 steel and/or aluminum tariffs will be subject to IEEPA “Reciprocal” tariffs.

CBP’s subsequent guidance messages clarified that this new assessment methodology is effective for entries beginning on June 4, 2025. CBP has been instructed in the EO to “mandat[e] strict compliance” with steel and aluminum content declaration requirements, and provide for “maximum penalties for noncompliance.”

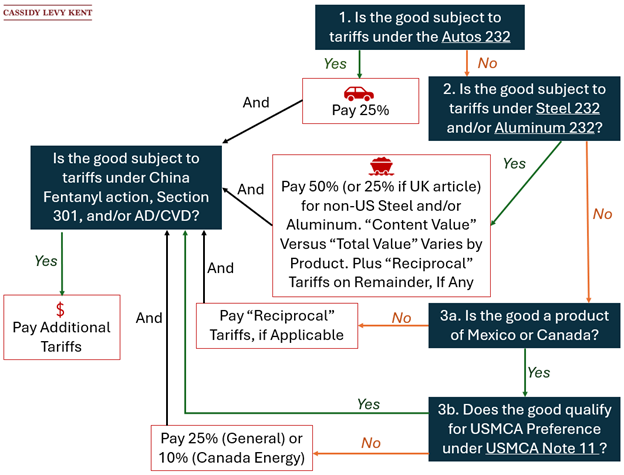

The updates to the hierarchy described above, as they pertain to the tariffs addressed in the late April “stacking” EO, are summarized in the graphic below:

Understanding Tariff Rate Fluctuations

Cassidy Levy Kent’s attorneys, compliance professionals, economists, and licensed customs brokers assist clients navigating tariff changes, supply chain challenges, and supply chain tracing. We have extensive experience counseling companies in the automotive, steel, and aluminum industries in how to optimize their supply chains for tariff considerations and maintain U.S. market access. We expect further developments in this space and will continue to provide updates. Please contact us with any questions about these developments.

This post has been updated with a new hyperlink to the Executive Order.