The U.S. Geological Survey yesterday released a draft list of 54 critical mineral commodities, in connection with its triennial review cycle. Compared to the most recent list, published in 2022, the new proposal would add copper, lead, potash, rhenium, silicon, and silver, while removing arsenic and tellurium. Interested parties have until September 25, 2025, to submit comments on the USGS proposal and may advocate for adding or removing mineral commodities. The final list will have direct implications for several other trade initiatives, including the ongoing Section 232 investigation of processed critical minerals.

Proposed List

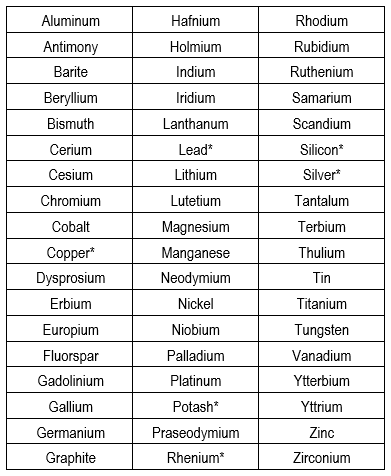

The 54 mineral commodities proposed for inclusion in the 2025 Critical Minerals List are as follows. Proposed additions are marked with an asterisk (*):

A List in Flux

The list of critical minerals is intended to fluctuate in response to economic and security developments. It has, therefore, varied significantly since the original list of 35 mineral commodities was established in 2018. The 2022 iteration of the list expanded coverage to 50 critical minerals.

Notably, two of this year’s proposed additions, potash and rhenium, were originally part of the list in 2018, but were among five mineral commodities removed in the 2022 edition. All of USGS’ other proposed additions to the 2025 list (copper, lead, silicon, and silver) would be entirely new entries. USGS’ two proposed removals, arsenic and tellurium, had previously appeared on all prior editions of the critical minerals list.

Comments on Additions or Removals Requested

The USGS notice indicates a general interest in receiving comments on the draft list of mineral commodities, including additions or removals. However, repeated emphasis is placed on “whether other minerals should be added to this list.” This includes (but is not limited to) the ability to argue in favor of the mineral commodities that USGS has already considered, but excluded from the draft list: arsenic, cadmium, feldspar, gold, helium, iron ore, mica, molybdenum, phosphates, selenium, strontium, and tellurium.

Moreover, in response to Executive Orders on Unleashing American Energy and Reinvigorating America’s Coal Industry, USGS specifically requests comments on the potential “inclusion of metallurgical coal and uranium” on the final critical minerals list. Notably, although uranium was part of the 2018 critical minerals list, it was removed in 2022, presumably due to its energy applications. Since the 2022 edition, the list of critical minerals has been maintained pursuant to Section 7002 of The Energy Act of 2020, which generally excludes “fuel minerals” from the definition of “critical mineral.”

Finally, from a procedural standpoint, USGS requests comments on the “merit of moving to an annual update for the USGS technical input to {the} List of Critical Minerals,” i.e., the methodology by which USGS evaluates a mineral commodity’s criticality.

Trade Implications

While the USGS list of critical minerals is not, by itself, a trade measure, it nevertheless informs and influences U.S. trade policy in several ways. First, the ongoing investigation of processed critical minerals pursuant to Section 232 of the Trade Expansion Act of 1962 (Section 232) defines “critical minerals” for purposes of that investigation by reference to the critical minerals list published by USGS, “or any subsequent such list,” in addition to separately and specifically including uranium. Thus, an expansion (or contraction) of the USGS list would likewise impact the potential scope of any Section 232 action.

Second, the U.S. Government has been actively pursuing engagement with allies and like-minded countries to secure supply chains for critical minerals through initiatives like the Minerals Security Partnership and the promotion of seabed mining. Moreover, recent trade dealmaking has referenced critical minerals cooperation as an intended outcome of certain announced deals.

Given the Administration’s thus-far consistent focus on critical minerals supply chains, there is a meaningful possibility that USGS’ critical minerals list will be invoked in other trade policy areas in the future.

Preparing Your Supply Chain

Cassidy Levy Kent’s attorneys, economists, compliance experts, and licensed customs brokers help companies sort through the latest changes with respect to trade and tariffs and develop strategic responses. Cassidy Levy Kent has extensive experience preparing comments for and engagement with U.S. government agencies and in counseling clients to plan compliant supply chains that manage tariff risks. Our team’s deep familiarity with trade law and policy enables clients to adapt and stay ahead of the curve.