This afternoon, President Trump signed an Executive Order clarifying the “stacking” of certain tariff regimes created pursuant to Section 232 of the Trade Expansion Act of 1962 (Section 232), Section 301 of the Trade Act of 1974 (Section 301), and the International Emergency Economic Powers Act (IEEPA).

Specifically, the Order specifies the applicable duty rate when an imported article would otherwise be subject to two or more of the following tariffs: Section 232 automobiles, Section 232 steel, Section 232 aluminum, IEEPA “fentanyl” Canada, and IEEPA “fentanyl” Mexico. The Order also establishes concomitant application of both Section 232 steel and aluminum tariffs for goods appearing on both lists and containing both steel and aluminum.

The new framework applies retroactively to entries on or after March 4, 2025, such that importers may request refunds.

A Clarified Tariff Hierarchy

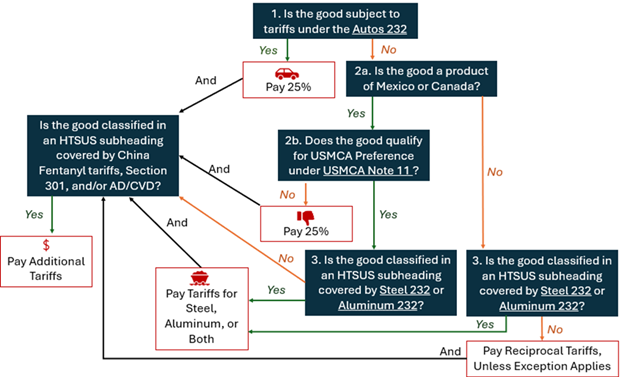

The Order clarifies the hierarchy applicable to imports covered by certain different tariff regimes. Discerning this clarification, however, requires importers to understand well the Harmonized Tariff Schedule (HTS) classification of the imported good and know whether each specific tariff measure applies to that classification. That said, the following rules will apply:

First, imported articles subject to Section 232 tariffs on automobiles and automotive parts will incur those Section 232 auto tariffs, but will not also incur tariffs pursuant to the Section 232 steel, Section 232 aluminum, IEEPA Canada, or IEEPA Mexico tariff regimes.

Second, imported articles subject to IEEPA Canada or IEEPA Mexico tariffs (but not Section 232 auto tariffs) will incur the relevant IEEPA tariff. That good will not also incur tariffs under the Section 232 steel or aluminum regimes. Because the Order specifies that a good should be “subject to tariffs” under these IEEPA regimes, a steel or aluminum product that qualifies for preference under the U.S.-Mexico-Canada Agreement (USMCA) and would not incur IEEPA tariff liability, would therefore remain subject to Section 232 steel and/or aluminum tariff regimes.

Third, imported articles subject to Section 232 steel and/or Section 232 aluminum tariffs (but not Section 232 auto tariffs, IEEPA Canada tariffs, or IEEPA Mexico tariffs) will incur the applicable Section 232 steel and aluminum tariffs. Importantly, to the extent that an article would otherwise be subject to both Section 232 steel and Section 232 aluminum tariffs, the Executive Order provides that both tariff regimes will apply.

Although not mentioned in this most recent Executive Order, the IEEPA reciprocal tariffs already provide exceptions for articles subject to the Section 232 autos, Section 232 steel, Section 232 aluminum, IEEPA Canada, or IEEPA Mexico tariff regimes.

Tariff “Stacking” Remains a Factor

Although this afternoon’s Order specifically forecloses certain tariffs from “stacking,” i.e., applying cumulatively, it also identifies certain other tariffs will stack.

Specifically, even if an imported article were subject to Section 232 tariffs on automobiles, steel, or aluminum; or IEEPA tariffs on Canada or Mexico; otherwise applicable tariffs imposed pursuant to U.S. antidumping and countervailing duty law, Section 301, or the IEEPA “fentanyl” action on the People’s Republic of China will continue to apply.

There also appears to be an intentional stacking regime that could conceivably apply if tariffs were applied to goods classified in an HTS subheading covered by one of the several pending Section 232 investigations that has not yet yielded a report or Presidential action.

Supply Chain Management

Given the evolving tariff landscape, and the retroactive applicability of this newest development, it may be worthwhile for importers to review recent entries to ascertain whether revisions are necessary or refunds may be available. Cassidy Levy Kent has extensive experience counseling companies in the automotive, steel, and aluminum industries in how to optimize their supply chains for tariff considerations and maintain U.S. market access.